Financial Service Cloud Accredited Professional - Spring'26 Release

Over 160 Questions | Cover All 3 Sections | Updated: 2026-01-25

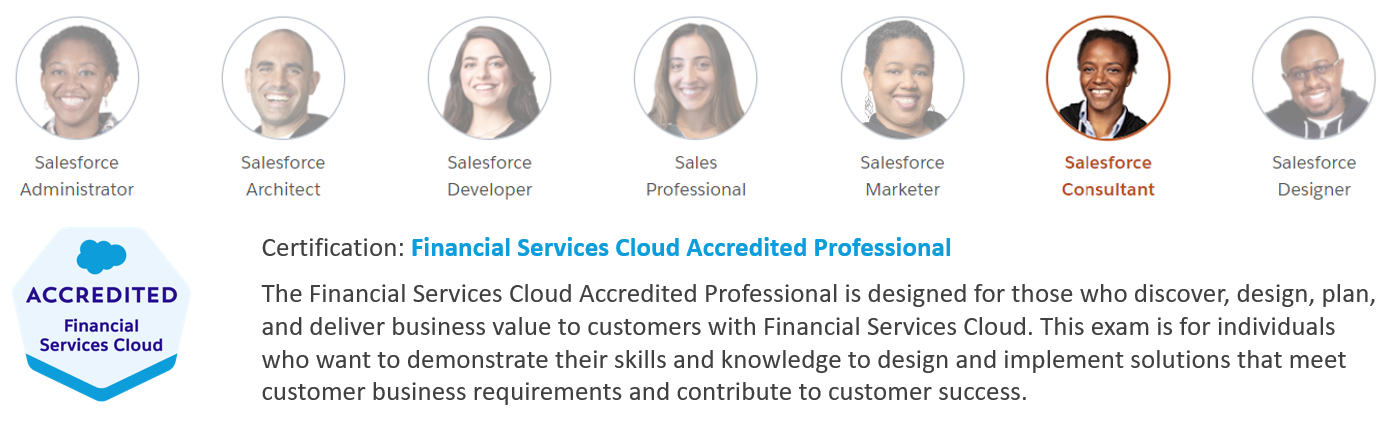

Read on for details about the Salesforce Certified Financial Services Cloud Accredited Professionalexam.

Discovery: 12%

Define/Design: 42%

Delivery: 46%

Part I: Discovery 12%

Part II: Define/Design 42% (I)

Part III: Define/Design 42% (II)

Part IV: Delivery 46% (I)

Part V: Delivery 46% (II)

2025-09-30 This is the second course I’ve used PHA practice exams to study with - and have passed both. Excellent quality- and the exams are constantly being improved for better usability. Well done!

2025-09-30 This is the second course I’ve used PHA practice exams to study with - and have passed both. Excellent quality- and the exams are constantly being improved for better usability. Well done!

Read Less2025-12-06 Loved the links to resources to explain the questions. Helped me understand concepts more deeply

2025-12-06 Loved the links to resources to explain the questions. Helped me understand concepts more deeply

Read Less2025-03-20

2025-03-20

Read Less2025-05-20 This is a great set of questions designed to help you understand concepts and successfully answer questions. Passed the exam with this course!

2025-05-20 This is a great set of questions designed to help you understand concepts and successfully answer questions. Passed the exam with this course!

Read Less2025-03-21 I passed my certification with 90% today, Thank you so much for helping me to aprove

2025-03-21 I passed my certification with 90% today, Thank you so much for helping me to aprove

Read Less2025-04-16

2025-04-16

Read Less2025-02-01 I was struggling to pass the exam with other courses but this practice test and links to Salesforce Help documentation made it easy to learn the latest release information. I passed on my next try after going through this practice test....

Read More2025-02-01 I was struggling to pass the exam with other courses but this practice test and links to Salesforce Help documentation made it easy to learn the latest release information. I passed on my next try after going through this practice test. Thanks!

Read Less2025-01-15 Extremely helpful for the exam. Cannot recommend enough!

2025-01-15 Extremely helpful for the exam. Cannot recommend enough!

Read Less2024-11-20 I am glad to share that I have completed yet another Salesforce Certification! Looking forward to my 5th certification in a couple of days.

2024-11-20 I am glad to share that I have completed yet another Salesforce Certification! Looking forward to my 5th certification in a couple of days.

Read Less2024-06-10

2024-06-10

Read Less2025-06-02 Questions were Straight forward wasnt overwhelming like another brand. I definetly do see myself purchasing again! Priscilla is amazing as well answering my doubts and reassuring me as well!

2025-06-02 Questions were Straight forward wasnt overwhelming like another brand. I definetly do see myself purchasing again! Priscilla is amazing as well answering my doubts and reassuring me as well!

Read LessUpon purchase, you will receive one year of access to the practice tests for your chosen certification. The questions are organized into various sections according to the exam guidelines, allowing you to assess your knowledge. Additionally, explanations are provided after each question to enhance your understanding.

Question 1:

Which of the following statements are correct when creating Financial Goals?

A. Users can only create savings-oriented goals.

B. Users require the Financial Goals permission set to work with Financial Goals

C. Users can associate a goal with a specific Financial Account.

D. Users can create goals for paying down debt

Correct Answer: D

Question 2:

A Salesforce Admin is configuring a new Action Plan Template. One task in that template needs to be picked up by the next available Advisor. What assignment logic should the Admin use when configuring this template task?

A. Action Plan Creator

B. Specific User

C. Account Team

D. Role

E. Queues

Correct Answer: E

Explanation: To assign a task to the next available Advisor, the Admin should use Queues as the assignment logic when configuring the template task. Queues are collections of records that can be assigned to multiple users who share workloads and responsibilities. By using Queues, the Admin can ensure that any Advisor who is part of the Queue can pick up the task when they are available.

Question 3:

Which three of these statements are true for Rollup by Lookup (RBL) in Financial Services Cloud?

A. An RBL (Rollup by Lookup) rule displays summary calculations of financial account information, such as account balances.

B. Person Accounts need to be enabled in order to use the Rollup by Lookup functionality.

C. The Rollup by Lookup (RBL) configuration updates the corresponding RBL summaries at the diem and group levels

D. Salesforce does not recommend or provide support for the reation or customization of Financial Services Cloud RBL rules

E. RBL rules do not require a lot of processing power.

Correct Answer: A C D

Explanation: The following statements are true for Rollup by Lookup (RBL) in Financial Services Cloud:

An RBL (Rollup by Lookup) rule displays summary calculations of financial account information, such as account balances. You can use RBL rules to aggregate financial account data across different levels of client relationships.

The Rollup by Lookup (RBL) configuration updates the corresponding RBL summaries at the diem and group levels. You can use RBL configuration to define which fields are rolled up and how they are calculated for each diem and group type.

Salesforce does not recommend or provide support for the creation or customization of Financial Services Cloud RBL rules. RBL rules are complex and require extensive testing and validation. If you need to create or customize RBL rules, you should contact a certified Salesforce partner or consultant.

Question 4:

During the delivery stage of a Financial Services Cloud (FSC) implementation, a consultant needs to think about how to utilize FSC-related objects. Which three things should the consultant consider when adopting such objects?

A. In a household, each household member is modeled as a Contact, and the household is modeled as an Account.

B. In a household, each of the household members is modeled as a Person Account and the household is modeled as an Account.

C. Role Hierarchy-based sharing can be disabled for the Financial Deal object, but can't be disabled for the Opportunity object.

D. Both the Financial Deal object and the Opportunity object support Compliant Data Sharing.

E. Interaction Summary is an enhancement of the standard Activity object. FSC implementations should use the Interaction Summary as a replacement for the Activity object.

Correct Answer: A C D

Explanation: Some considerations when adopting FSC-related objects are:

In a household, each household member is modeled as a Contact, and the household is modeled as an Account. A household is a type of relationship group that represents a group of clients who have a direct relationship with one another and share financials, such as spouses and their dependent children. A household is modeled as an Account record with a custom record type of Household. Each household member is modeled as a Contact record that is related to the household Account. A household can also have related accounts and contacts that are not part of the household, but are associated with it for some reason.

Both the Financial Deal object and the Opportunity object support Compliant Data Sharing. Compliant Data Sharing (CDS) is a feature of FSC that allows granular control over access to sensitive data in Account and Opportunity objects. CDS can help financial services companies comply with regulations and policies that restrict data visibility based on user roles. CDS can also be enabled for the Financial Deal object, which is a custom object that represents a business opportunity or transaction with a client. The Financial Deal object can be used instead of or in addition to the Opportunity object, depending on the business needs.

Interaction Summary is an enhancement of the standard Activity object. FSC implementations should use the Interaction Summary as a replacement for the Activity object. Interaction Summary is a custom object that captures the details of a client interaction, such as a meeting, a call, or an email.

Interaction Summary can be linked to other FSC objects, such as Financial Accounts, Financial Goals, Financial Deals, or Relationship Groups. Interaction Summary can also have participants, which are records that represent the people or groups involved in the interaction.

Question 5:

What actions can a Wealth Advisor take from the Life Events card? Choose 3 answers

A. Create Case

B. Create Lead & Referral

C. Open an Account

D. Request Record Approval

E. Create Opportunity

Correct Answer: B D E

Explanation: From the Life Events card, a Wealth Advisor can take the following actions:

Create Lead & Referral: This action creates a lead record for a new prospector a referral record for an existing client based on the life event information.

Request Record Approval: This action initiates an approval process for the life event record to ensure compliance and quality standards.

Create Opportunity: This action creates an opportunity record to track the potential revenue from the life event.

Question 6:

Agents for an insurance company need to know the current and past weather conditions when creating customer claims. The consultant implements a Flex Card for weather conditions in the console to ensure the agents can access the information. The Flex Card needs to provide fields extracted from a weather API and an account field from Salesforce.

Which method should the consultant use, according to best practices?

A. APEX classes

B. Streaming API

C. Data Raptor Extract

D. Integration Procedure

Correct Answer: D

Explanation: An Integration Procedure is a feature of Velocity that allows users to create and execute data integration tasks between Salesforce and external systems. An Integration Procedure can perform various operations, such as extract, transform, load, query, or update data from different sources and targets. An Integration Procedure can also invoke other Velocity features, such as Data Raptors, OmniScripts, or Calculations.

To implement a Flex Card for weather conditions in the console, the consultant should use an Integration Procedure that can do the following steps:

Query the weather API using an HTTP action and pass the account address as a parameter. Extract the relevant fields from the weather API response, such as temperature, humidity, precipitation, etc.

Query the account field from Salesforce using a Data Raptor Extract action and pass the account ID as a parameter.

Merge the weather API fields and the account field into a single data set using a List Merge action. Return the data set to the Flex Card using a Return action.

Question 7:

Multiple Select

Which two statements are true for a Group in Financial Services Cloud?

A. Financial Services Cloud includes a group record type for households

B. A group is a type of account record that people and businesses can be related to through the Financial Account relationship object

C. A group is a type of account record that people and businesses can be related to through the account contact relationship object.

D. Financial Services Cloud includes a group record type for businesses

Correct Answer: A C

Explanation: The following statements are true for a Group in Financial Services Cloud:

Financial Services Cloud includes a group record type for households, which is a record type that represents a collection of individuals who share financial goals, such as family members or roommates.

A group is a type of account record that people and businesses can be related to through the account contact relationship object, which is a junction object that links an account to a contact or an individual and defines their role or relationship with that account.

Question 8:

One administrator user at a financial services company needs to help management build reports and gain insights into business performance by including branch management reportable objects.

Which two considerations should the administrator include when configuring the report?

A. Branch Unit Related Record report types have related object names, including Lead, Account, and Contact, but exclude Financial Account.

B. Bankers with Branches with Opportunities, Accounts, Leads and Contacts report types are available for creating reports with Branch Unit Related Records.

C. The reportable objects include Banker. Branch Unit, Branch Unit Related Records, and Branch Unit Customer.

D. When Branch Unit is the primary object, the administrator can select Branch Unit Customers or Branch Unit Related Records as related objects.

Correct Answer: B C

Explanation: The following considerations should be included when configuring the report with branch management reportable objects:

Bankers with Branches with Opportunities, Accounts, Leads, and Contacts report types are available for creating reports with Branch Unit Related Records. These are standard report types that allow users to create reports that show data from Banker, Branch Unit, Opportunity, Account, Lead, Contact, and Branch Unit Related Record objects.

The reportable objects include Banker, Branch Unit, Branch Unit Related Records, and Branch Unit Customer. These are custom objects that are part of the branch management feature in Financial Services Cloud. Banker is an object that represents a banker or an employee who works at a branch unit. Branch Unit is an object that represents a physical location where bankers provide services to customers. Branch Unit Related Record is an object that represents a record that is related to a branch unit, such as an opportunity, an account, a lead, or a contact. Branch Unit Customer is an object that represents a customer who has a relationship with a branch unit.

When Branch Unit is the primary object, the administrator can select Branch Unit Customers or Branch Unit Related Records as related objects. This means that the administrator can create reports that show data from Branch Unit and its related objects by using lookup fields or junction objects

Question 9:

What is a key step in identifying different business processes and outlining encompassing system flows based on the existing environment when setting up Salesforce Financial Services Cloud (FSC)?

A. Creating a new Salesforce instance from scratch for the customer

B. Importing the customer's existing data into Salesforce FSC without any modifications

C. Implementing a generic, one-size-fits-all solution for all customers

D. Conducting a gap analysis between the customer's current processes and Salesforce FSC capabilities

Correct Answer:D

Explanation: A gap analysis is a key step in identifying different business processes and outlining encompassing system flows based on the existing environment when setting up Salesforce Financial Services Cloud (FSC). A gap analysis is a method of comparing the current state of a system or process with the desired future state and identifying the gaps or differences between them. By conducting a gap analysis, a consultant can understand the customer's pain points, requirements, and expectations and design a solution that leverages the best practices and features of Salesforce FSC.

Question 10:

How should developers configure customized nodes for display in Actionable Relationship Center (ARC)?

A. Select Use FlexCard from the node Display tab to show the node in a FlexCard

B. Reference the Lightning web component in the Display properties of the custom ARC relationship graph.

C. Select OmniScript from the node Actions tab

D. Reference the FlexCard in the Display properties of the custom ARC relationship graph.

Correct Answer:D

Explanation: To configure customized nodes for display in Actionable Relationship Center (ARC), developers should reference the FlexCard in the Display properties of the custom ARC relationship graph. A FlexCard is a tool that allows users to create custom user interfaces for displaying data from Salesforce or external systems using OmniScripts and Integration Procedures. A custom ARC relationship graph is a metadata type that defines the nodes and edges of a custom relationship graph for ARC. By referencing the FlexCard in the Display properties of the custom ARC relationship graph, developers can customize the look and feel of the nodes and display data from various sources on them.